FEDERAL OFF-SITE RENEWABLE ENERGY PURCHASES AND RENEWABLE ENERGY CERTIFICATES

Federal agencies have the option to acquire renewable energy from off-site renewable energy projects or renewable energy certificates (RECs) if building an on-site renewable energy plant is not feasible. Purchasing renewable energy can assist an organisation in reaching its renewable energy targets and does not need project investment. You can buy renewable energy that isn’t produced on the agency’s federal site by using the following methods:

RENEWABLE ENERGY CERTIFICATES

Renewable Energy Certificates (RECs) are sold separately from commodity electricity and are often referred to as green certificates, tradable renewable certificates, green tags, or renewable energy credits. They indicate the environmental qualities of the power produced by renewable energy projects. For government buildings situated in areas with limited access to renewable energy, RECs are appealing. The Federal Renewable Energy Certificate Guide published by the Council on Environmental Quality contains REC guidelines. The Green Power Partnership website of the U.S. Environmental Protection Agency (EPA) has further details about RECs, including information on their prices. The companies listed here carry out REC aggregations on behalf of government agencies:

- Defense Logistics Agency-Energy

- General Services Administration

- Western Area Power Administration.

OFF-SITE RENEWABLE POWER PURCHASES

Competitive renewable power: Federal agencies may acquire renewable power through competitive energy procurements in states having competitive electricity markets. The websites of the National Renewable Energy Laboratory and the EPA Green Power Partnership include more information.

Programmes for regulated utility green pricing: Green pricing is an elective service that lets users encourage greater utility company investment in renewable energy sources. Customers who take part in the programme pay an extra fee on their power bills to offset the cost of the additional renewable energy.

Renewable energy pricing: A growing number of utilities are now offering renewable energy tariffs, which may assist federal agencies save money and achieve their renewable energy targets.

INDIAN LAND-BASED RENEWABLE ENERGY PURCHASES

Agencies that purchase power from renewable projects located on Indian property (as defined by the Energy Policy Act of 1992, 25 U.S.C. 3501, et seq.) are eligible for double credit towards the renewable targets under section 203(c)(3) of the Energy Policy Act of 2005 (EPAct 2005, 42 U.S.C. 15852).

Federal agencies may offer priority to tribal enterprises when buying energy goods, power, or energy by-products under Section 503 of the EP Act 2005 (25 U.S.C. 3502).

HOW MUCH ELECTRICITY DOES AN AMERICAN HOME USE?

In 2022, the typical amount of electricity bought by an average U.S. residential customer annually stood at 10,791 kilowatthours (kWh), roughly 899 kWh per month. Louisiana recorded the highest annual electricity purchases per residential customer, reaching 14,774 kWh, while Hawaii reported the lowest at 6,178 kWh per residential customer.

It’s worth noting that electricity purchases might not reflect the entire electricity usage for some residential customers due to the increasing prevalence of solar photovoltaic (PV) systems, most of which are grid-connected and use net metering. These systems effectively lower electricity purchases. In states with numerous residential net-metered PV systems, household electricity consumption could significantly exceed electricity purchases. The Residential Energy Consumption Survey (RECS) considers household-level electricity usage, encompassing both electricity bought and consumed from on-site PV systems.

For instance, the 2020 RECS estimates that in Hawaii, where there’s a relatively high number of residential net-metered PV systems, the annual electricity consumption per household in 2020 was 7,976 kWh, while in Louisiana, where residential PV systems are less common, it was 14,779 kWh. According to the Electric Sales, Revenue, and Average Price report for 2020, total annual electricity purchases per residential customer were 6,446 kWh in Hawaii and 14,407 kWh in Louisiana.

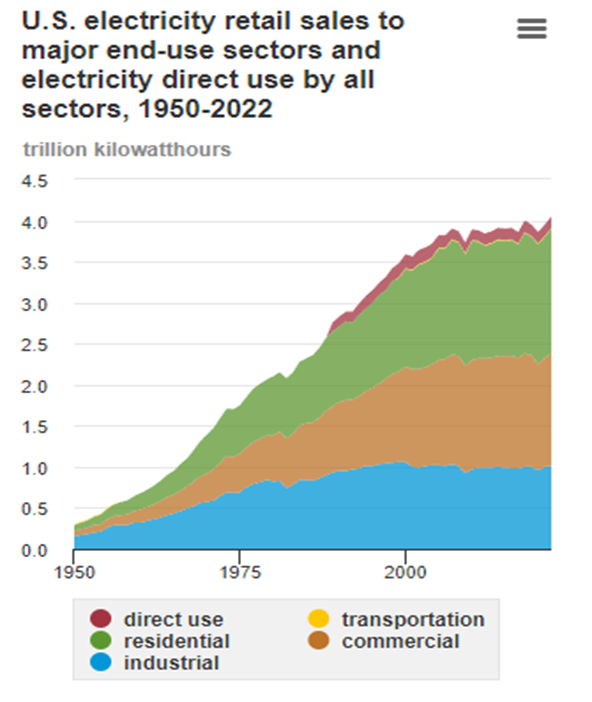

ELECTRICITY CONSUMPTION – UNITED STATES (2022) – ABOUT 4 TRILLION KILOWATTHOURS (kWh)

Electricity is an essential part of modern life and important to the U.S. economy. People use electricity for lighting, heating, cooling, and refrigeration and for operating appliances, computers, electronics, machinery, and public transportation systems. Total U.S. electricity consumption in 2022 was about 4.07 trillion kWh, the highest amount recorded and 14 times greater than electricity use in 1950. Total annual U.S. electricity consumption increased in all but 11 years between 1950 and 2022, and 8 of the years with year-over-year decreases occurred after 2007.

Total electricity end-use consumption includes retail sales of electricity to consumers and direct use electricity. Direct use electricity is used by the same industrial or commercial sector facility where it is produced. The industrial sector accounts for most direct use of electricity. Total direct use of electricity by the industrial and commercial sectors was about 3.5% of total electricity end-use consumption in 2022.

Total U.S. electricity end-use consumption in 2022 was about 3.2% higher than in 2021.1 In 2022, retail electricity sales to the residential sector were about 2.6% higher than in 2021, and retail electricity sales to the commercial sector were about 4.7% higher than in 2021. Electricity retail sales to the industrial sector in 2022 were about 2.0% higher than in 2021 but were about 4.1% lower than in 2000, the year of highest U.S. retail sales to the industrial sector. The industrial sector’s percentage share of total U.S. electricity retail sales was about 31.1% in 2000 and 26.0% in 2022.

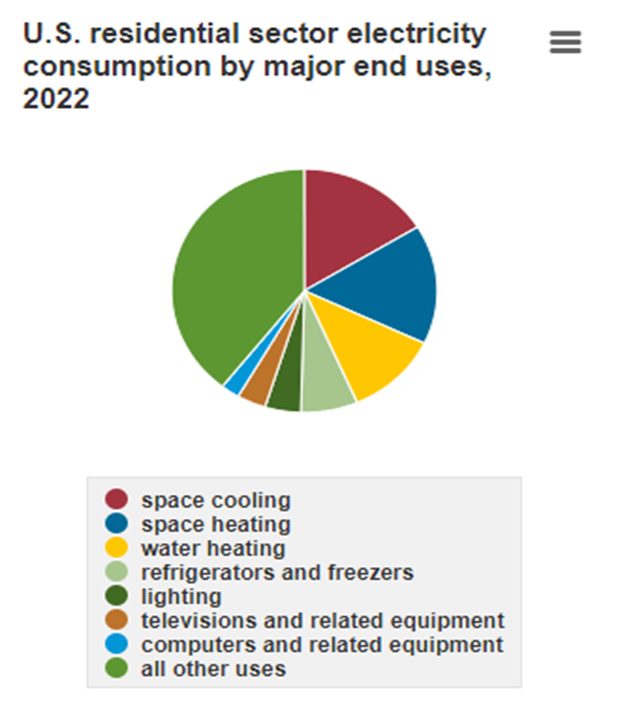

HEATING AND COOLING – LARGEST RESIDENTIAL ELECTRICITY USES

Heating and cooling (air conditioning) account for the largest annual uses of electricity in the residential sector. Because these uses are mainly weather related, the amounts and their shares of total annual residential electricity consumption vary from year to year. The Residential Energy Consumption Survey (RECS) data for 2020 indicate that air conditioning was the largest use of electricity in homes.

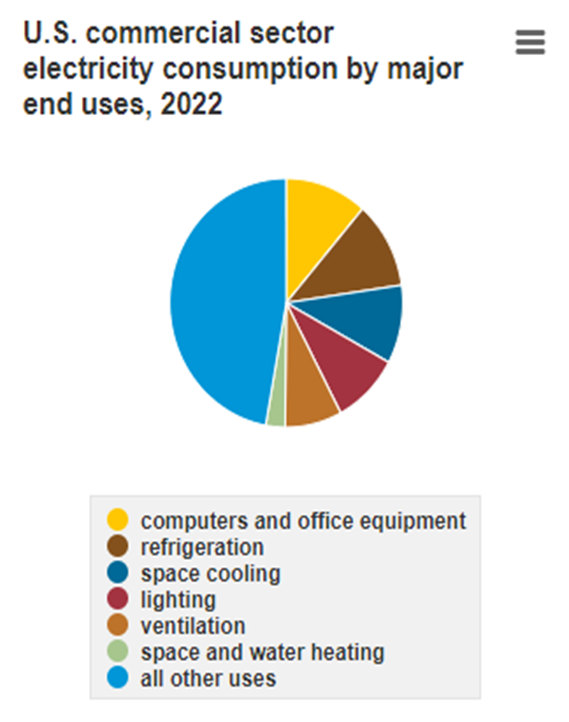

COMPUTERS & OFFICE EQUIPMENT – LARGEST SHARE OF COMMERCIAL SECTOR ELECTRICITY CONSUMPTION

Five uses of electricity hold the largest shares of total annual electricity use in the commercial sector: computers and office equipment (combined), refrigeration, space cooling, lighting, and ventilation.

Historically, electricity use for lighting was typically the largest share of total annual commercial sector electricity use, but its share has declined over time, mainly because of the increasing use of high-efficiency lighting equipment. Conversely, the amount and share of electricity used for computers and office equipment has increased over time. Space cooling requirements are determined by weather, climate, and building design and by heat produced by lighting equipment, computers, office equipment, miscellaneous appliances, and building occupants.

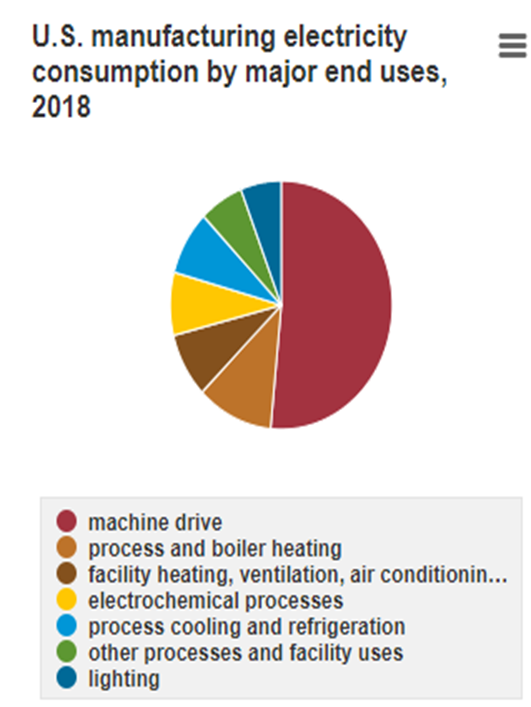

MACHINE DRIVES – LARGEST USE OF ELECTRICITY BY U.S. MANUFACTURERS

The industrial sector plays a significant role in electricity consumption, utilizing power for various operations and processes essential to manufacturing and production. Different industries have distinct electricity usage patterns, tailored to their specific needs and processes.

Industries such as aluminum and steel manufacturing rely on electricity for processing heat, which is crucial for shaping and molding metals. Other sectors, like food processing, heavily utilize electricity for cooling, freezing, and refrigerating food products to maintain quality and safety standards.

Many manufacturers, particularly in sectors like pulp and paper and lumber mills, have their own electricity generation facilities. These facilities often employ combined heat and power systems, where electricity generation is accompanied by the simultaneous production of useful thermal energy, such as steam or hot water, which is utilized in manufacturing processes. Additionally, some manufacturers may generate surplus electricity beyond their own needs and may sell this excess power to the grid or to other consumers.

The Manufacturing Energy Consumption Survey (MECS) provides comprehensive data on electricity usage across various manufacturing industries and end uses in selected years, offering valuable insights into consumption patterns and trends. The Annual Energy Outlook (AEO) also offers estimates and projections for electricity purchases by the industrial sector, segmented by industry type and manufacturer.

According to the AEO2023 Reference case, in 2022, manufacturers account for approximately 78% of total annual electricity purchases within the industrial sector. Other sectors, including construction, mining, and agriculture, also contribute to industrial electricity demand, albeit to a lesser extent.

Understanding electricity usage patterns across different industries is essential for policymakers, utilities, and manufacturers alike, as it informs efforts to enhance energy efficiency, promote sustainable practices, and ensure reliable and affordable electricity supply for industrial operations.

ELECTRICITY USE IN THE UNITED STATES AND REST OF THE WORLD – PROJECTED TO GROW

The near-term fluctuations in U.S. electricity demand may indeed be influenced by factors such as year-to-year changes in weather patterns. However, long-term trends in electricity demand are primarily driven by broader factors such as economic growth and improvements in energy end-use efficiency.

In the Annual Energy Outlook 2023 (AEO2023) Reference case, it is projected that the annual growth in total U.S. electricity demand will average approximately 1% from 2022 through 2050. This projection reflects the anticipated impact of economic expansion on electricity consumption, as well as the ongoing efforts to enhance energy efficiency across various sectors of the economy.

On a global scale, the International Energy Outlook 2023 anticipates an overall increase in electricity consumption across all major energy end-use sectors through 2050. This growth is attributed to the expansion of electricity grids in regions where access to electricity is currently limited, such as China, India, and Africa.

As electrification efforts expand in these regions and more energy consumers gain access to electricity, there is a corresponding reduction in the consumption of end-use fossil fuels. This shift towards electrification leads to an increase in electricity consumption. While efficiency improvements will help mitigate some of the consumption increases, the rise in consumption due to electrification is expected to outweigh the decreases attributed to efficiency gains.

Overall, the projections highlight the complex interplay between economic development, electrification efforts, and energy efficiency initiatives in shaping long-term trends in electricity demand both domestically in the United States and globally. These trends underscore the importance of continued investments in energy infrastructure, technological innovation, and policy measures aimed at promoting sustainable energy use and addressing the challenges of rising electricity demand.

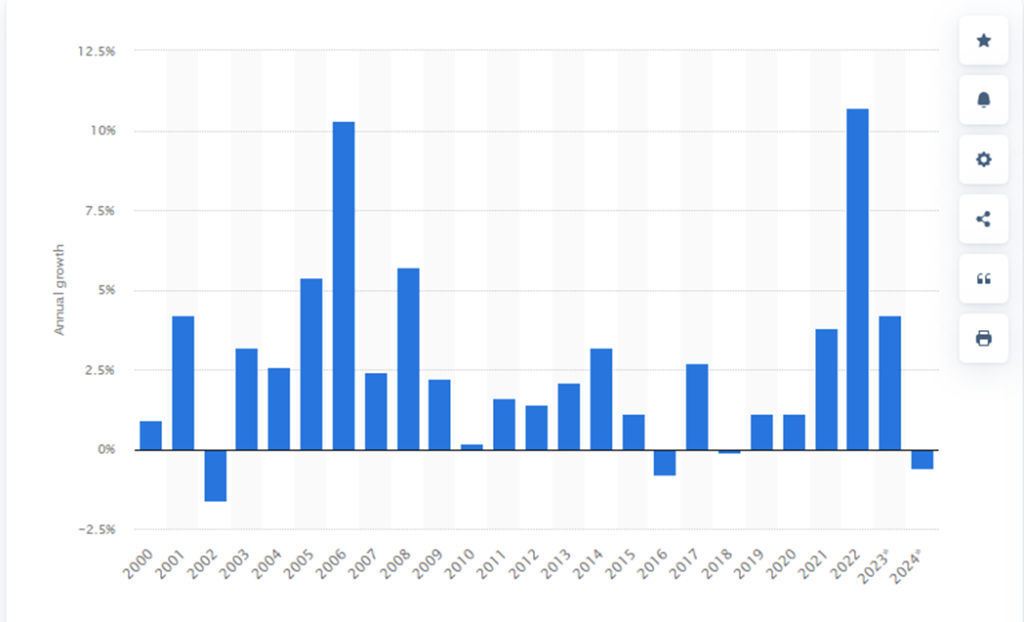

YEAR ON YEAR GROWTH IN RESIDENTIAL ELECTRICITY PRICES IN THE UNITED STATES (2000 – 2024)

Residential Electricity Price Growth In The U.S. 2000-2024

Retail residential electricity rates in the United States have climbed steadily over the previous several decades. In 2022, prices increased by 10.7 percent year on year, the fastest rate since the turn of the century. Residential prices are expected to climb further, increasing by 4% in 2023 compared to the previous year.

Drivers of Electricity Price Growth

The price of electricity is influenced by a multitude of factors, including the various energy sources utilized for generating power. In the United States, electricity expenses are particularly sensitive to natural gas prices, given the significant role that natural gas plays in the country’s energy mix.

Natural gas prices can be highly volatile, influenced by factors such as supply and demand dynamics, geopolitical events, weather patterns, and global economic conditions. As natural gas is increasingly exposed to higher-paying overseas markets through liquefied natural gas (LNG) exports, domestic prices in the United States can experience upward pressure.

Historically, fluctuations in natural gas prices have had a direct impact on electricity prices, as natural gas-fired power plants often set the marginal cost of electricity production. During periods of elevated natural gas prices, electricity prices tend to climb accordingly, reflecting the increased cost of fuel for power generation.

Additionally, electricity consumption is projected to rise in many regions, driven by factors such as population growth, economic development, and changes in lifestyle and behavior. Climate change is expected to exacerbate this trend, particularly in areas that may experience more frequent and severe weather events, leading to greater demand for heating or cooling to maintain comfortable indoor temperatures.

As electricity demand increases, particularly during peak periods, utilities may need to rely on more expensive sources of power generation to meet the higher levels of demand, further contributing to upward pressure on electricity prices.

In summary, the interplay between natural gas prices, electricity demand, and the impacts of climate change are expected to exert significant influence on electricity prices in the United States, with potential implications for consumers, businesses, and the broader economy.

Which States Pay The Most For Electricity?

Electricity rates can exhibit significant variation across different states and regions within the United States. As of May 2023, Hawaii stands out with the highest power prices in the country, reaching approximately 43 cents per kilowatt-hour. This elevated cost is primarily attributed to the reliance on crude oil as a primary fuel source for generating electricity in the state. Given Hawaii’s geographical isolation and lack of access to conventional energy resources, importing and utilizing crude oil for electricity generation significantly drives up costs.

In contrast, states like Idaho boast some of the lowest retail rates for electricity. A key factor contributing to Idaho’s comparatively low electricity prices is its substantial reliance on hydroelectricity for power generation. Hydroelectric power generation relies on the abundant availability of water resources, requiring minimal fuel inputs, which translates to lower operating costs and, consequently, lower retail electricity rates for consumers.

Furthermore, in some cases, development expenditures associated with energy infrastructure projects, such as hydroelectric dams, may be spread out over several decades. This prolonged investment horizon can help mitigate upfront costs, contributing to the affordability of electricity for consumers in regions heavily reliant on hydroelectric power.

Overall, the divergence in electricity rates across states underscores the significant influence of factors such as fuel sources, infrastructure development, and geographical considerations on the cost of electricity production and distribution.

| SERIAL NUMBER | YEAR | ANNUAL GROWTH (PERCENTAGE) |

| 1 | 2000 | 0.9% |

| 2 | 2001 | 4.2% |

| 3 | 2002 | -1.6% |

| 4 | 2003 | 3.2% |

| 5 | 2004 | 2.6% |

| 6 | 2005 | 5.4% |

| 7 | 2006 | 10.3% |

| 8 | 2007 | 2.4% |

| 9 | 2008 | 5.7% |

| 10 | 2009 | 2.2% |

| 11 | 2010 | 0.2% |

| 12 | 2011 | 2.6% |

| 13 | 2012 | 1.6% |

| 14 | 2013 | 1.4% |

| 15 | 2014 | 3.2% |

| 16 | 2015 | 1.1% |

| 17 | 2016 | -0.8% |

| 18 | 2017 | 2.7% |

| 19 | 2018 | -0.1% |

| 20 | 2019 | 1.1% |

| 21 | 2020 | 1.1% |

| 22 | 2021 | 3.8% |

| 23 | 2022 | 10.7% |

| 24 | 2023 | 4.2% |

| 25 | 2024 | -0.6% |

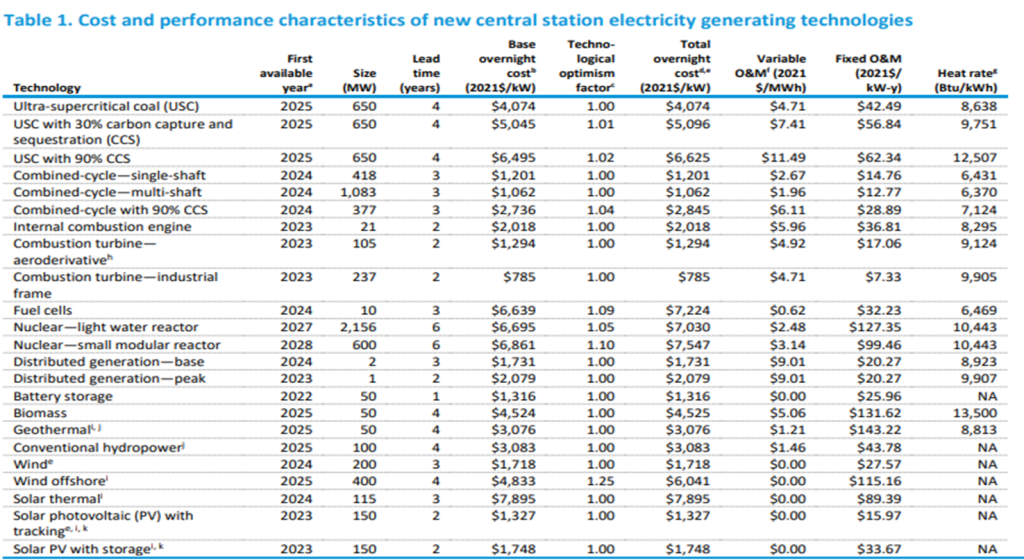

COST AND PERFORMANCE CHARACTERISTICS OF NEW GENERATING TECHNOLOGIES

Table 1 provides an overview of our assessment of the costs associated with developing and installing various generating technologies utilized in the electric power sector. It’s worth noting that generating technologies commonly found in end-use applications, such as combined heat and power or rooftop solar photovoltaics (PV), will be detailed elsewhere in the Assumptions document.

The costs presented in Table 1, unless otherwise specified, represent the expenses associated with establishing a typical facility for each generating technology, before adjusting for regional cost factors. Overnight costs, in this context, exclude any interest accrued during the construction and development of the plant. Additionally, technologies with limited commercial experience may incorporate a technological optimism factor, accounting for the tendency to underestimate the full engineering and development costs associated with new technologies during the research and development phase.

It’s important to acknowledge that all technologies exhibit some degree of cost variability, influenced by factors such as project size, location, and access to essential infrastructure (such as grid interconnections, fuel supply, and transportation). Notably, for wind and solar PV technologies, the cost favorability of the lowest-cost regions compounds the inherent variability in regional costs, leading to a significant disparity between unadjusted costs and the capacity-weighted average national costs, as observed from recent market experiences.

To address this discrepancy, we report a weighted average cost for both wind and solar PV, taking into account the regional cost factors assumed for these technologies in AEO2022 and the actual regional distribution of builds that occurred in 2020 (as detailed in Table 1). This approach aims to provide a more accurate representation of the costs associated with wind and solar PV technologies, accounting for both regional variations and real-world market trends.

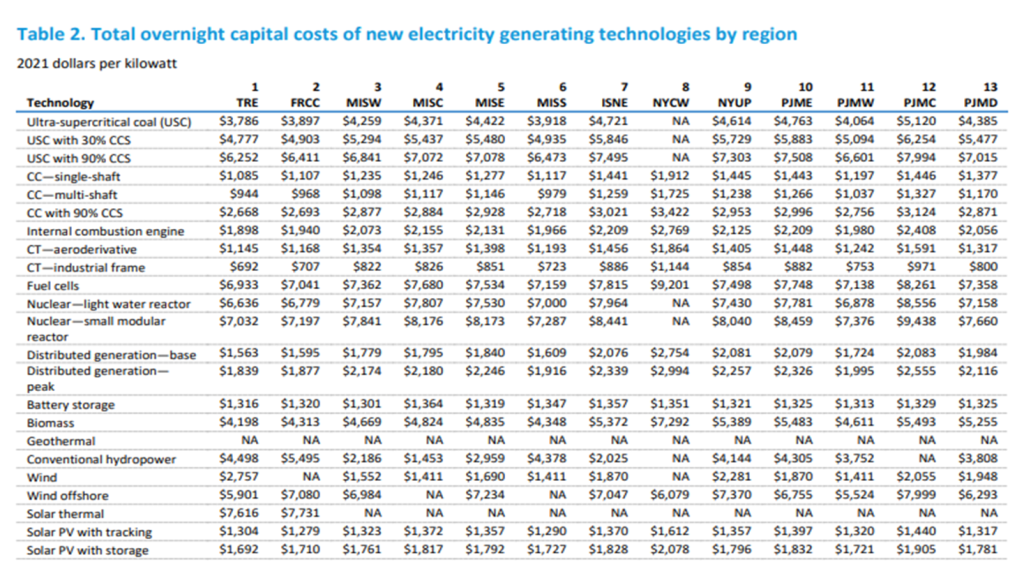

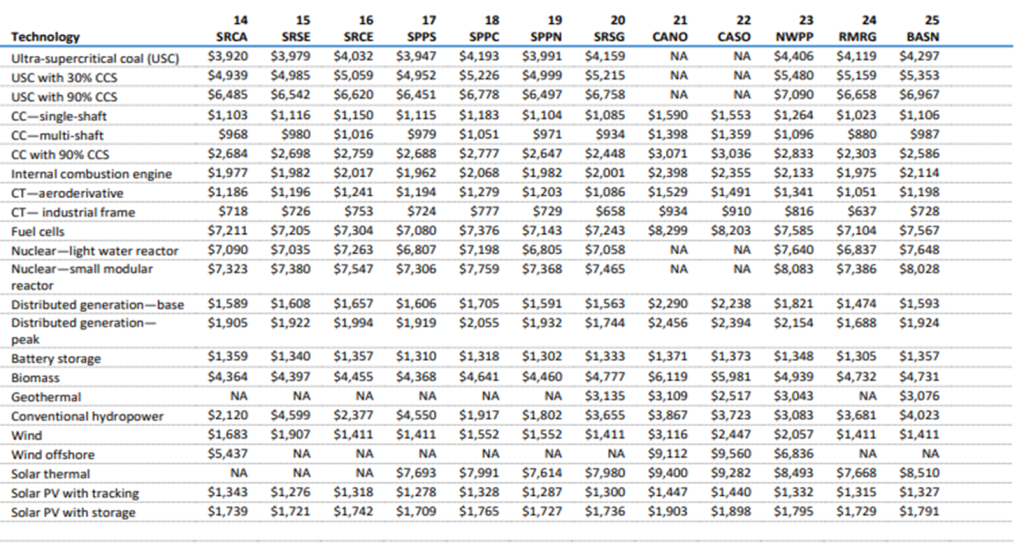

Table 2 presents a comprehensive overview of the overnight costs associated with each technology and electricity region, provided the resource or technology can be constructed within the specified region. These regional costs are adjusted to account for various locality factors, including adjustments to address ambient air conditions for technologies incorporating a combustion turbine and additional costs linked to accessing remote wind resources.

The impact of temperature, humidity, and air pressure on the available capacity of a combustion turbine is considered, and our modeling incorporates these potential effects by applying an additional cost multiplier by region.

Unlike many other generation technologies where fuel can be transported to the plant, wind generators must be situated in areas with optimal wind resources. Typically, sites located near existing transmission infrastructure with access to a road network or situated on lower development-cost lands are prioritized for development. Subsequently, additional costs may arise to access sites with less favorable characteristics.

To represent this trend, a multiplier is applied to the capital costs of wind plants, increasing as the best sites within a region are developed. This approach aims to reflect the evolving costs associated with accessing wind resources as development progresses within a region.

UNDERSTANDING CARBON FOOTPRINTS

“Carbon footprint” refers to the total amount of greenhouse gases, particularly carbon dioxide, that are emitted into the atmosphere as a result of our activities and lifestyle choices. This footprint encompasses various aspects of our daily lives, including the food we consume, the energy sources we use to power our homes and transportation, and the products we buy.

Every action we take, from driving a car to using electricity, contributes to our carbon footprint. For example, burning fossil fuels like coal, oil, and natural gas for electricity and transportation releases carbon dioxide into the atmosphere, increasing our carbon footprint. Similarly, the production and transportation of food, as well as the disposal of waste, also generate greenhouse gas emissions that contribute to our overall footprint.

Understanding and reducing our carbon footprint is essential for mitigating climate change and minimizing our impact on the environment. By making conscious choices to reduce energy consumption, adopt sustainable transportation options, and support environmentally friendly practices, we can decrease our carbon footprint and contribute to a healthier planet.

Our present collective carbon footprint is straining our planet to its breaking point, which will have disastrous effects on our species and life as we know it. For this reason, reducing our carbon footprints is imperative. It would be helpful to quickly review the things that SMEs can do to achieve net zero and be more environmentally conscious as we recently wrote a whole essay on the subject:

Reducing our individual and collective footprints are key to slowing down climate change due to, and hold additional benefits. Here are a few simple actions to start reducing your carbon footprint today:

- Travel smart: Opt for public transportation, carpooling, biking, or walking whenever possible.

- Energy efficiency: Upgrade to energy-efficient appliances and light bulbs.

- Mind your diet: Eat more plant-based meals and reduce food waste.

- Conserve water: Fix leaks and reduce water waste in your home.

The first step towards living a more sustainable lifestyle is realising your own carbon footprint and taking action to decrease it, but this won’t be sufficient to stop climate change on its own. To facilitate cooperative and business-driven activities, we require a system. Here is where carbon credits start to play a bigger role since they give businesses a useful means of offsetting emissions that they are unable to completely eradicate.

In our quest for environmental stewardship, the combination of lowering our carbon footprint and using carbon credits to offset emissions we are unable to completely eliminate is essential.

CARBON CREDITS – UNLOCKING SUSTAINABILITY

A novel tool for lowering greenhouse gas emissions worldwide, carbon credits serve as a transition to a more sustainable future. Individuals and companies may purchase carbon credits to offset their inevitable carbon footprint, therefore supporting global environmental conservation and sustainability initiatives.

In the fight against climate change, carbon credits are in the front, providing financial incentives for individuals and businesses to reduce their carbon emissions. These incentives not only increase the allure of investing in environmentally sound methods, but they also provide vital financing for environmental initiatives that may not have been possible without this assistance. Carbon credits also promote international collaboration by serving as a global carbon currency, bringing nations and communities together in the common goal of lowering emissions globally. As we strive towards a more sustainable future, this team effort is crucial in showcasing the ability and potential of carbon credits to propel significant environmental advancement.

THE KYOTO PROTOCOL: SETTING THE STAGE FOR CARBON CREDITS

The Kyoto Protocol, which was created in 1997 as part of the United Nations Framework Convention on Climate Change (UNFCCC), signalled the beginning of official international initiatives to reduce greenhouse gas emissions. With the intention of bringing emissions down to 5% below 1990 levels between 2008 and 2012, this historic pact established legally enforceable emissions reduction objectives for the European Union and 37 industrialised countries. These goals were then amended in 2012, bringing them up to 2013–2020. The ground-breaking idea of carbon credits, intended to offer financial incentives for reducing emissions, was at the heart of the Kyoto Protocol. The Protocol established the worldwide framework for carbon credits by introducing Emissions Trading, the Clean Development Mechanism (CDM), and Joint Implementation (JI).

Important details:

- Developed nations were required by the Kyoto Protocol to reduce their emissions by 5% below 1990 levels between 2008 and 2012. Through an updated treaty, this was later extended to 2013–2020.

- The pattern for selling carbon credits was supplied by JI, CDM, and emissions trading, among other novel processes.

PARIS AGREEMENT: A NEW DAWN IN GLOBAL CLIMATE COOPERATION

The 2015 adoption of the Paris Agreement marked a significant worldwide movement towards more inclusive and ambitious climate action, making it a strong replacement for the Kyoto Protocol. In contrast to the Kyoto Protocol, which imposed legally enforceable obligations only on industrialised nations, the Paris Agreement promotes international cooperation in the fight against global warming. Aiming to keep the rise in global temperature far below 2°C, this inclusive approach aspires to be 1.5°C over pre-industrial levels. The Kyoto Protocol’s Clean Development Mechanism (CDM) is about to be replaced by the Sustainable Development Mechanism (SDM), which was proposed as part of the Paris Agreement. This represents a change in the carbon credit market and a new direction for international environmental policies.

Important details:

- The Kyoto Protocol established a 2°C objective for global warming; the Paris Agreement set a more aggressive aim of 1.5°C.

- Unlike the Kyoto Protocol’s legally enforceable objectives exclusive to industrialised nations, it includes a global framework that encourages all countries to contribute.

- Replaced the CDM with the SDM, which reflected changes in carbon credits after the Kyoto Protocol.

REASON WHY SOME COUNTRIES OPTED OUT: ECONOMIC AND STRATEGIC CONSIDERATIONS

Some of the largest emitters of greenhouse gases expressed opposition to the Kyoto Protocol due to concerns about economic justice and competitiveness. The United States, for example, declined to ratify the Protocol, citing potential economic consequences and the absence of legally binding obligations for poorer nations. Similarly, Canada withdrew from the Protocol in 2011, expressing doubts about its effectiveness in controlling global emissions without cooperation from major polluters such as China and the United States.

These decisions underscore the complex interplay between economic, strategic, and environmental factors that influence global climate accords and the use of carbon credits. Concerns about economic competitiveness and the perceived lack of equitable burden-sharing among nations have often been cited as reasons for reluctance or opposition to climate agreements.

Furthermore, the withdrawal of major emitters from international climate agreements can undermine global efforts to address climate change effectively. The intricate dynamics between economic interests, geopolitical considerations, and environmental priorities highlight the challenges inherent in achieving consensus on climate action and the utilization of carbon credit mechanisms as part of broader climate mitigation strategies.

Important information:

- In light of developing nations’ pledges and worries about economic effects, the United States and Canada chose not to participate.

- It draws attention to the strategic factors in climate accords that go hand in hand with environmental ones.

CARBON CREDITS – A MECHANISM TO MEET TARGETS

The Kyoto Protocol introduced pioneering mechanisms such as Emissions Trading, the Clean Development Mechanism (CDM), and Joint Implementation (JI) to assist nations in meeting their emissions reduction targets. These mechanisms laid the groundwork for the evolution of the carbon credit system, enabling the trading of emission allowances and facilitating international collaboration on carbon sequestration projects.

The CDM, in particular, played a significant role in promoting sustainable development while reducing emissions by allowing developed countries to invest in emission reduction projects in developing countries. Similarly, Joint Implementation facilitated emissions reduction projects in transition economies.

The Paris Agreement built upon the successes and lessons learned from the Kyoto-era mechanisms by introducing the Sustainable Development Mechanism (SDM). This mechanism aims to enhance the global carbon credit framework by integrating sustainability considerations and promoting broader collaboration on emissions reduction projects.

Overall, the evolution of carbon credit mechanisms from the Kyoto Protocol to the Paris Agreement reflects the ongoing efforts to refine and improve international climate governance, with the ultimate goal of achieving meaningful and sustainable emissions reductions worldwide.

Key facts:

- Emissions Trading, CDM, and JI were introduced under Kyoto as innovative ways to meet reduction targets.

- The Paris Agreement’s SDM builds on these mechanisms to further improve the carbon credits system.

DECLINE OF THE CDM: TRANSITIONING TO A NEW ERA

The advent of the Paris Agreement marked a significant transition in the landscape of carbon credit mechanisms, particularly with the emergence of the Sustainable Development Mechanism (SDM) and the subsequent decline in prominence of the Clean Development Mechanism (CDM). This transition reflects the global community’s adaptive approach to evolving environmental challenges and the need for more comprehensive and flexible frameworks to address them effectively.

The SDM, with its broader scope and enhanced flexibility, aims to overcome the shortcomings of the CDM and provide a more robust framework for carbon credit initiatives. By integrating sustainability considerations and promoting a holistic approach to emissions reduction, the SDM seeks to align carbon credit mechanisms more closely with the ambitious climate goals outlined in the Paris Agreement.

The shift from CDM to SDM signifies a continued evolution in the mechanisms governing carbon credits, highlighting the global commitment to advancing climate action and achieving long-term sustainability objectives. It underscores the importance of continually reassessing and refining approaches to carbon mitigation in response to changing environmental, social, and economic realities.

Key facts:

- The CDM is being replaced by the more robust SDM under Paris reflecting an adaptive approach.

- SDM has a wider scope and flexibility compared to CDM.

CHALLENGES IN PARTICIPATION: NAVIGATING GLOBAL CLIMATE DYNAMICS

The challenges encountered during the participation in the Kyoto Protocol shed light on the complexities inherent in global climate agreements. Reluctance from major emitters such as the U.S. and China to commit to binding emissions reduction targets under the Kyoto Protocol underscored the necessity for a more inclusive approach.

The Paris Agreement, with its universal framework for climate action, aims to address some of these challenges by encouraging all nations, irrespective of their economic status, to contribute towards global emissions reduction. By fostering a more inclusive and collaborative approach, the Paris Agreement seeks to mobilize collective action to combat climate change effectively.

However, despite the universal nature of the Paris Agreement, the nuances of national and global priorities continue to influence the level of participation and commitment to carbon credit initiatives. Factors such as economic considerations, geopolitical dynamics, and domestic political agendas can impact countries’ willingness to engage fully in climate action efforts, including carbon credit mechanisms.

Overall, while the Paris Agreement represents a significant step forward in global climate governance, ongoing efforts are needed to address participation challenges and ensure meaningful contributions from all nations towards achieving climate objectives.

Key facts:

- Universal participation under Paris was designed to address the lack of major emitters’ commitment under Kyoto.

- National interests still impact countries’ levels of commitment to climate agreements.

THE ROLE OF THE INTERNATIONAL TRANSACTION LOG (ITL): ENSURING TRANSPARENCY AND ACCOUNTABILITY

The International Transaction Log (ITL) serves as a cornerstone in the operationalization of carbon credits by promoting transparency, accountability, and efficiency in carbon credit transactions. Established by the Secretariat of the Conference of Parties, the ITL plays a pivotal role in meticulously recording carbon credit transactions to prevent potential issues such as double-counting of emissions reductions or the sale of identical credits multiple times.

By bridging national emissions trading registries and the United Nations Framework Convention on Climate Change (UNFCCC), the ITL exemplifies the global commitment to establishing a transparent and accountable carbon credit system. This commitment underpins the credibility of international emissions trading initiatives and ensures the integrity of carbon credit transactions on a global scale.

In summary, the ITL stands as a vital mechanism for maintaining the credibility and effectiveness of carbon credit mechanisms, contributing to the overall success of international efforts to address climate change.

Key facts:

- The ITL prevents double-counting and ensures transparency in carbon credits trading.

- It bridges national registries and UNFCCC to enable international cooperation.

RISKS AND MITIGATION IN CARBON CREDIT PROGRAMS: ENSURING VIABILITY AND SUSTAINABILITY

Carbon credit projects entail inherent regulatory and market risks, necessitating robust mitigation strategies to ensure their viability and sustainability. The complexities associated with obtaining regulatory approvals, accurately monitoring actual emissions, and navigating volatile market dynamics present significant challenges to carbon credit projects.

One effective strategy for mitigating risks involves leveraging approved Clean Development Mechanism (CDM) technologies and entering into long-term fixed-price contracts. By utilizing established CDM technologies, projects can streamline the approval process and enhance their credibility. Moreover, entering into long-term fixed-price contracts provides stability and predictability in revenue streams, thus mitigating market risks associated with price fluctuations.

The evolving carbon credit framework, transitioning from the CDM to Sustainable Development Mechanism (SDM) under the Paris Agreement, reflects a continued effort to address these risks and enhance the sustainability of carbon credit projects. The SDM aims to incorporate broader sustainability criteria and improve the transparency and integrity of carbon credit mechanisms, thereby reducing regulatory and market risks. This transition underscores the commitment to strengthening carbon credit projects and maximizing their contribution to global climate action.

Key facts:

- Regulatory and market risks pose viability challenges for carbon credit projects.

- CDM methodologies and long-term contracts help mitigate risks.

CONTROVERSIES IN LAND USE PROJECTS: NAVIGATING CARBON SEQUESTRATION CHALLENGES

Land use projects under the Kyoto Protocol, such as afforestation and reforestation initiatives, were designed to contribute to greenhouse gas removals and emissions reductions. However, these projects encountered resistance due to challenges in accurately estimating and tracking greenhouse gas removals over extended periods. The complexities associated with measuring carbon sequestration, particularly in vast forested areas, underscore the controversies and challenges inherent in the carbon credits domain.

The Paris Agreement introduces an enhanced framework for carbon credit initiatives, offering avenues to address some of these challenges. By promoting a more robust and transparent approach to land use projects within the carbon credits framework, the Paris Agreement seeks to overcome the hurdles encountered in previous initiatives. This includes implementing improved methodologies for measuring and verifying carbon sequestration, enhancing monitoring mechanisms, and ensuring greater accountability and transparency in reporting.

Overall, the Paris Agreement’s provisions for carbon credit initiatives hold the potential to resolve long standing issues and strengthen the effectiveness of land use projects in mitigating climate change. By addressing challenges and promoting transparency, the Agreement aims to foster greater confidence in carbon credit mechanisms and facilitate increased investment in sustainable land use practices.

Key facts:

- Estimating and monitoring carbon sequestration from land use projects is complex.

- Caused controversies under Kyoto but the Paris Agreement provides scope to improve.

CARBON CREDITS – UNLOCKING SUSTAINABILITY

One credit equals one ton of carbon dioxide. These credits are generated by projects that reduce, avoid, or remove greenhouse gas emissions from the atmosphere, such as:

- Renewable energy projects (wind, solar, hydro)

- Reforestation and forest conservation

- Energy efficiency improvements

Understanding and participating in the carbon credit system empowers us to take meaningful steps towards a sustainable future. By responsibly utilizing this tool, we can strive for balance and sustainability for our planet. Engaging with carbon credits enables us to play an active role in reducing emissions, both as individuals and as businesses.

Recognizing and participating in the carbon credit economy presents a mainstream opportunity for businesses to contribute to broader solutions for climate change. It enables the offsetting of carbon footprints and direct involvement in the fight against global warming. Moreover, engagement in carbon credits fosters innovation by channeling funds into projects dedicated to creating a more sustainable and cleaner world.

Purchasing carbon credits offers companies a practical step towards making a real difference and complements efforts to shrink carbon footprints. Carbon credits have transcended being a theoretical concept and are making a tangible impact on our planet right now. Projects worldwide funded by carbon credits are already significantly reducing emissions and promoting sustainability across various sectors. Projects that are examples of such successes in a variety of fields, include the following:

Renewable Energy

Renewable energy projects play a pivotal role in reducing greenhouse gas emissions by generating electricity from sustainable sources such as solar, wind, hydro, or geothermal power. By displacing fossil fuel-based power generation, these projects contribute significantly to emissions reduction and climate change mitigation efforts.

Renewable energy projects, such as wind farms, are eligible for earning carbon credits based on the amount of greenhouse gas emissions they displace compared to conventional fossil fuel-based power generation. These credits represent the environmental benefit of using renewable energy instead of fossil fuels. By selling these carbon credits on the carbon market, renewable energy projects can generate additional revenue, thereby enhancing their financial viability and making them more attractive investments.

In essence, renewable energy projects not only provide clean and sustainable electricity but also offer economic incentives through carbon credit income. This dual impact underscores the importance of transitioning towards renewable energy sources as a key strategy in addressing climate change while promoting sustainable development.

Energy Efficiency

Energy efficiency projects play a crucial role in reducing energy consumption and improving energy efficiency across various sectors, including buildings, industries, and transportation. By implementing measures such as upgrading insulation, installing efficient lighting systems, or optimizing industrial processes, businesses can significantly reduce their energy usage and associated greenhouse gas emissions.

These energy efficiency projects are eligible for earning carbon credits because they contribute directly to emissions reduction. By reducing energy consumption, businesses lower their carbon footprints, thereby mitigating their environmental impact. The carbon credits earned through these projects provide a financial incentive for businesses to invest in energy-saving technologies and practices. Additionally, the income generated from carbon credits can offset a portion of the initial investment required for implementing these projects, while the long-term operational cost savings serve as further justification for the investment.

In summary, energy efficiency projects not only help businesses reduce their environmental footprint but also offer economic benefits through carbon credit income and long-term cost savings. This creates a win-win scenario where businesses contribute to climate change mitigation while also improving their bottom line.

Afforestation

Trees play a crucial role in mitigating climate change by acting as carbon sinks. Through the process of photosynthesis, trees absorb carbon dioxide from the atmosphere and store it in their biomass and in the soil. Afforestation, which involves establishing new forests on land that was previously not forested, and reforestation, which involves restoring forests on land that was previously deforested or degraded, are both effective strategies for sequestering carbon and offsetting emissions.

Afforestation and reforestation projects are eligible for earning carbon credits because they contribute directly to climate change mitigation. By planting trees and restoring forest ecosystems, these projects enhance carbon sequestration, trapping greenhouse gases that would otherwise remain in the atmosphere and exacerbate global warming. As a result, these projects are recognized and incentivized within carbon credit mechanisms, providing financial support for their implementation and encouraging further investment in sustainable land use practices.

Methane Capture

Methane is indeed a potent greenhouse gas with a significantly higher warming potential than carbon dioxide. It is commonly emitted during the production and transportation of fossil fuels such as coal, oil, and natural gas. Methane capture and utilization projects play a crucial role in mitigating greenhouse gas emissions and advancing sustainability objectives.

By capturing methane emissions from sources such as landfills or livestock operations and utilizing it as a fuel or converting it into other products, these projects effectively reduce greenhouse gas emissions. As a result, they qualify for earning carbon credits, reflecting their contribution to emissions reduction and environmental sustainability.

Investing in carbon credits, therefore, extends beyond environmental benefits; it can also be advantageous for investors. By supporting methane capture and utilization projects through carbon credit investments, individuals and organizations not only contribute to mitigating climate change but also align their investments with sustainability goals. This dual impact underscores the significance of investing in carbon credits as a means to promote environmental stewardship and reap financial benefits simultaneously.

The Ripple Effect

The impact of carbon credit-supported projects extends far beyond merely reducing carbon emissions and has repeatedly demonstrated downstream benefits for society, the economy, and the environment. These projects frequently lead to the creation of local jobs in green industries, offering communities new employment opportunities. Additionally, initiatives like clean cookstove projects substantially reduce air pollution, thereby enhancing the health of affected communities. Furthermore, reforestation and conservation efforts play a pivotal role in safeguarding endangered species and their habitats, thus preserving biodiversity.

This multifaceted impact underscores the value of carbon credit projects in fostering a healthier, more sustainable, and economically vibrant world. Investing in carbon credits, whether as an individual or a company, represents a direct contribution to these impactful projects. By offsetting your carbon footprint through carbon credits, you actively support a cycle of improvement that extends far beyond carbon reduction alone. It serves as a tangible way to take responsibility for your environmental impact and contribute to positive change on a global scale.

Carbon Credits Foster Sustainable Growth

Now that we’ve established how carbon credits are both a tool for offsetting emissions and a catalyst for sustainable growth, it’s easy to see how funding carbon credits stimulate sustainable practices across sectors:

- Renewable Energy Expansion – Carbon credits finance the development of renewable energy sources, reducing reliance on fossil fuels and promoting cleaner air.

- Innovation in Green Technology – Investments in carbon credits fuel research and development in green technologies, paving the way for breakthroughs in sustainability.

- Sustainable Agriculture – Carbon credit projects support sustainable farming practices that improve soil health, conserve water, and reduce greenhouse gas emissions.

The carbon credit system not only addresses environmental issues but also offers economic benefits. By participating in projects funded by carbon credits, we’re not just tackling climate change; we’re also sparking significant economic opportunities. These projects often demand skilled labor, leading to the creation of new job opportunities within the burgeoning green industries. Moreover, by encouraging the adoption of low-carbon technologies, carbon credits are unlocking new markets and revenue streams for forward-thinking businesses, particularly those pioneering in sustainability.

These incentives are drawing global investments into sustainable initiatives, with a marked impact in developing countries where such financial injections can lead to transformative changes. Through our collective engagement in the carbon credit market, we’re contributing to the fight against climate change, supporting environmentally responsible economic development, and steering the global economy towards a low-carbon future. This commitment to carbon credits transcends mere environmental stewardship; it signifies a proactive investment in crafting a sustainable and thriving future for our planet.

Beyond Emission Reductions

Now that we’ve established some of the peripheral benefits carbon credits provide beyond mere accountability, let’s take a deeper look at the environmental conservation, social development, and economic benefits carbon credits are already offering communities worldwide:

- Environmental Conservation

- Carbon credit projects serve as vital instruments in the preservation and restoration of critical habitats, safeguarding endangered species, and maintaining biodiversity through initiatives focused on natural habitat conservation. Additionally, these projects support forest restoration endeavors such as reforestation and afforestation, which play a dual role in capturing carbon and enhancing soil health and water cycles. In doing so, carbon credit projects make substantial contributions to environmental sustainability by mitigating climate change impacts and fostering ecological resilience.

- Social Advancements

- Carbon credits exert a substantial influence on communities, extending beyond environmental preservation to encompass a spectrum of social and economic benefits. By funding projects that reduce emissions, carbon credits contribute to enhancing air quality, thereby bolstering public health within communities. Moreover, the revenue generated from carbon credit initiatives often supports education initiatives, providing communities with valuable resources for sustainable development. This multifaceted support underscores the profound impact of carbon credits in promoting holistic well-being and advancing socio-economic progress alongside environmental preservation.

- Economic Benefits

- Carbon credit initiatives play a crucial role in driving sustainable growth by fostering training and employment opportunities, thereby creating sustainable livelihoods for local communities. These projects frequently result in improved infrastructure, such as upgraded roads and access to clean water supplies, showcasing the tangible economic benefits and upliftment they bring to the regions where they are implemented.

- A Holistic Approach to Sustainability

- Investing in carbon credits enables individuals and organizations to play a part in fostering a healthier planet, building resilient communities, and cultivating a sustainable economy. These credits facilitate projects aimed at emissions reduction while simultaneously enhancing people’s lives by improving access to vital services and bolstering livelihoods. By integrating environmental stewardship into economic growth strategies, carbon credits underscore the interconnectedness of planetary health, social equity, and economic prosperity. This approach highlights the significance of carbon credits in shaping a future where the well-being of the planet, social fairness, and economic vitality are mutually reinforced.

- The Future of Carbon Credits

- Looking ahead, carbon credits emerge as a pivotal component in the global strategy to combat climate change. Their significance in mitigating emissions, fostering sustainable initiatives, and stimulating economic advancement highlights their capacity to mold a sustainable future for all.

- Evolving Markets and Technologies

- Investing in carbon credits offers a means for everyone to play a role in fostering a healthier planet, building stronger communities, and cultivating a sustainable economy. These credits facilitate projects aimed at emissions reduction while concurrently enhancing people’s lives by improving access to essential services and bolstering livelihoods. By integrating environmental care into economic growth strategies, carbon credits underscore the interconnection between the planet’s health, social equity, and economic prosperity. This approach exemplifies the pivotal role of carbon credits in shaping a future where the well-being of the planet, social equity, and economic vitality are intricately intertwined.

- Challenges and Opportunities

- The path forward for carbon credits presents both challenges and opportunities for growth and advancement. Establishing universal standards will be instrumental in ensuring the effectiveness and reliability of carbon credits. Moreover, enhancing accessibility to carbon credits for small businesses and individuals will foster inclusivity in the fight against climate change. Integrating carbon credits into broader sustainability strategies will amplify their impact and propel us closer to achieving our environmental objectives. The future of carbon credits reflects our collective dedication to a sustainable planet. Through informed action, investment, and advocacy, we can harness the potential of carbon credits to drive substantial positive change globally, securing a greener and more sustainable future for generations to come.

CARBON CREDIT COMPLIANCE MARKETS

Compliance markets are instituted by governments and are compulsory for specific industries or sectors. In these markets, carbon credits are employed as a regulatory tool to enforce compliance and ensure that companies adhere to mandatory emission reduction targets. Typically, carbon credits in compliance markets are allocated or auctioned by governmental authorities. Companies operating within regulated sectors can acquire or trade these credits on a secondary market to fulfill their compliance obligations.

Examples of compliance markets are:

CARBON CREDIT VOLUNTARY MARKETS

Voluntary markets operate independently of government regulation and are primarily fueled by companies and individuals who opt to offset their emissions voluntarily. Carbon credits in these markets are typically generated through projects aimed at reducing or removing greenhouse gases. These credits can be acquired directly from project developers or through dedicated platforms designed for carbon credit trading.

Participation in voluntary markets offers companies an avenue to assume accountability for their carbon footprint and showcase their dedication to sustainability. By purchasing carbon credits, entities demonstrate their commitment to mitigating climate change and supporting emission reduction initiatives. These markets serve as a valuable opportunity for businesses to proactively address their environmental impact and contribute to a more sustainable future.

Examples of voluntary markets are:

HOW ARE CARBON CREDITS ISSUED?

Carbon credits can be issued for projects that can be proven to reduce carbon emissions or absorb carbon from the environment. These may include, but are not limited to:

- Renewable energy initiatives.

- Energy efficiency programs.

- Afforestation & reforestation projects.

- Waste management schemes.

Indeed, these projects not only mitigate emissions but also foster sustainable development and job creation. Through the issuance of carbon credits, governments, international organizations, and private enterprises can bolster the implementation of these initiatives and ensure their financial viability. Let’s delve deeper into how each of the aforementioned projects leverages carbon credits:

- Issuing Carbon Credits from Wind Farms

- Wind farms play a crucial role in reducing the demand for fossil fuels and the resultant greenhouse gas emissions by generating clean, renewable energy. The emission reductions facilitated by wind farms can be measured and translated into carbon credits. These credits are subsequently available for sale on the carbon market.

- Issuing Carbon Credits from Afforestation

- These projects facilitate the absorption of carbon dioxide from the atmosphere and its sequestration in biomass through tree planting initiatives. The quantity of carbon dioxide absorbed by the trees can be measured and translated into carbon credits. These credits are subsequently available for sale to entities or individuals seeking to offset their emissions.

- Issuing Carbon Credits from Waste Management

- Waste management schemes generate carbon credits by implementing strategies aimed at reducing carbon dioxide and methane emissions linked to waste. These initiatives often involve activities such as food rescue, plastic recycling, and landfill gas management. Both public and private waste management organizations have the capacity to produce carbon credits, which are tradable commodities in carbon markets. This dual impact not only contributes to environmental preservation but also yields economic advantages through the sale of these credits.

CARBON OFFSET PROJECTS’ AUXILIARY AND ANCILLARY BENEFITS

Carbon offset projects offer a myriad of benefits extending beyond mere emission reductions. They frequently contribute to sustainable development, job creation, and community support. For instance, a renewable energy endeavor may furnish clean electricity to remote regions previously dependent on fossil fuels. Similarly, reforestation initiatives can generate employment opportunities for local communities while safeguarding biodiversity.

Through the issuance of carbon credits, the carbon market furnishes a financial impetus for the implementation of these projects. This incentivization mechanism attracts investment and fosters the proliferation of sustainable practices. Moreover, carbon offset projects play a pivotal role in transitioning towards a low-carbon economy by advocating for renewable energy adoption, sustainable agriculture practices, and other climate-friendly activities.

HOW ARE CARBON CREDITS CERTIFIED?

The certification process plays a pivotal role in the issuance of carbon credits, safeguarding their credibility and integrity. Certification bodies are tasked with verifying that emission reduction projects adhere to specific criteria and standards before granting carbon credits. This process entails a comprehensive assessment of the project’s methodology, monitoring systems, and emission reduction calculations.

Initiating the certification process involves project developers submitting a detailed project design document (PDD) to the certification body. This document outlines the project’s objectives, methodologies, and anticipated emission reductions. Upon receipt, the certification body conducts an initial evaluation to ascertain if the project meets requisite requirements.

Projects deemed eligible progress to the validation phase, during which the certification body conducts an on-site inspection to verify compliance with the approved methodology. This includes scrutinizing monitoring systems, data collection methods, and emission reduction calculations.

Following validation, the certification body issues a validation report and assigns a unique identification number to register the project. Subsequently, the project can commence generating carbon credits based on verified emission reductions. These credits typically manifest as tradable certificates, facilitating transactions on the carbon market.

Notable examples of certification bodies encompass entities such as VCS, Gold Standard, and the Climate Action Reserve. These organizations have established stringent standards and guidelines for carbon credit projects and furnish independent verification and certification services. Through their certification processes, they ensure that projects meet requisite criteria and contribute substantially to actual emission reductions.

CARBON CREDITS VERIFICATION

Verification constitutes another critical phase in the issuance of carbon credits, playing a pivotal role in upholding their credibility and integrity. Verification bodies such as Det Norske Veritas (DNV), SGS, and TÜV SÜD possess extensive expertise in verifying emission reduction projects and ensuring adherence to international standards. Through the provision of independent verification services, these entities bolster confidence in the carbon market and safeguard the legitimacy of carbon credits.

By conducting thorough assessments and evaluations, verification bodies validate the accuracy of emission reduction calculations, monitoring systems, and data collection methodologies employed by project developers. This rigorous scrutiny helps to verify compliance with established standards and guidelines, thereby enhancing the transparency and reliability of carbon credit issuance.

Ultimately, the involvement of reputable verification bodies fosters trust among stakeholders, investors, and market participants, thereby fortifying the integrity of the carbon market and advancing global efforts to combat climate change.

Carbon Credits Verification Process

Verification commences with project developers submitting a comprehensive verification report to the verification body. This report contains detailed information regarding the project’s emission reduction calculations, monitoring systems, and data collection methodologies.

Subsequently, the verification body meticulously reviews the report and undertakes an impartial assessment to ascertain whether the project meets requisite standards. This evaluation may involve requesting supplementary information or conducting on-site visits to validate the accuracy of the project’s data. During these visits, the verification body scrutinizes monitoring equipment, data collection procedures, and emission reduction calculations, while also identifying any potential discrepancies or inaccuracies in the project documentation.

Upon completion of the assessment, the verification body issues a verification statement affirming the accuracy of the project’s emission reduction calculations. This statement serves as the basis for the certification body to allocate carbon credits to the project. Additionally, the verification body may offer recommendations for enhancing monitoring systems or data collection methodologies to ensure ongoing adherence to standards.

CARBON CREDITS – GOVERNMENT’S ROLE

Governments wield significant influence in the issuance of carbon credits and the drive for emission reductions. They formulate policies and regulations that establish emission reduction targets for industries and sectors, as well as oversee the allocation and trading of carbon credits. Government agencies are entrusted with the task of issuing and monitoring carbon credits, ensuring their validity and adherence to stipulated criteria.

Carbon credit policies crafted by governments vary across nations but typically aim to incentivize emission reductions and foster sustainable practices. These policies encompass a range of measures such as cap-and-trade systems, carbon taxes, incentives for renewable energy adoption, and other mechanisms designed to motivate companies to curtail their emissions. By issuing carbon credits, governments furnish tangible incentives for companies to invest in emission reduction endeavors.

The entities responsible for administering carbon credits differ from one country to another. Some nations designate dedicated agencies or departments within the government to oversee the carbon market, while others task regulatory bodies or environmental agencies with the supervision of emissions and issuance of carbon credits.

CARBON CREDITS – INTERNATIONAL ORGANIZATION’S ROLE

International organizations play a vital role in the issuance of carbon credits and the reduction of emissions on a global scale. These organizations are responsible for establishing standards and guidelines for carbon credit projects, offering technical assistance to project developers, and facilitating carbon credit trading.

An exemplary international organization engaged in carbon credits is the United Nations Framework Convention on Climate Change (UNFCCC), which oversees the Clean Development Mechanism (CDM). The CDM enables developing countries to earn carbon credits by implementing emission reduction projects. This mechanism has been instrumental in fostering sustainable development and technology transfer in these nations.

Another notable example is the International Civil Aviation Organization’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). CORSIA seeks to offset the growth in international aviation emissions by mandating airlines to purchase carbon credits from approved projects. This initiative is anticipated to significantly contribute to emissions reduction within the aviation sector.

International organizations also contribute to carbon credit projects through funding and support. For instance, the World Bank’s Forest Carbon Partnership Facility (FCPF) provides financial incentives for countries to curb emissions from deforestation and forest degradation. By issuing carbon credits for such initiatives, international organizations stimulate private sector investment and advance sustainable development goals.

CARBON CREDITS – PRIVATE ENTERPRISES’ ROLE

As previously noted, private entities and corporations are pivotal participants in the carbon market, serving in dual roles as purchasers and sellers of carbon credits.

Private Enterprise Carbon Credit Buyers

Numerous companies opt to fulfill compliance obligations, meet sustainability targets, or honor corporate social responsibility mandates by purchasing carbon credits from projects designed to mitigate or eliminate greenhouse gas emissions.

Private Enterprise Carbon Credit Sellers

Private companies specializing in issuing carbon credits operate on a financial model centered around the development and execution of emission reduction projects, akin to those outlined previously. By implementing such projects, these companies generate carbon credits corresponding to the emissions reductions achieved. Subsequently, they monetize these credits by selling them on carbon markets for profit.

Examples of private companies engaged in issuing carbon credits encompass a variety of sectors, including renewable energy developers, waste management firms, and forestry organizations. These entities not only demonstrate the financial viability of investing in emission reduction initiatives but also contribute significantly to the advancement of a low-carbon economy. Moreover, they play a pivotal role in fostering sustainable practices and facilitating education on emission reduction strategies.

Through their activities, these companies not only drive financial incentives for others to pursue similar investments but also actively contribute to the transition towards a more sustainable and climate-resilient future. By leveraging their expertise and resources, they make substantial contributions to global efforts aimed at mitigating climate change and promoting environmental sustainability.

Private Enterprises’ Role in Education

Private companies play a significant role in promoting carbon credit projects through their marketing and communication endeavors. Oftentimes, companies opt to showcase their carbon offset initiatives as part of their branding strategies, sustainability agendas, or corporate social responsibility commitments. These efforts serve to raise awareness about the importance of carbon offsetting and encourage others to engage in similar practices.

By highlighting the benefits of carbon credits, private companies serve as catalysts for inspiring broader action against climate change. Through their promotional activities, they not only demonstrate their commitment to environmental stewardship but also motivate stakeholders across various sectors to participate in mitigating greenhouse gas emissions. Ultimately, the promotion of carbon credit projects by private companies contributes to the collective effort towards a more sustainable and climate-resilient future.

CARBON MARKET ADVISORY

To facilitate the transition to a decarbonized economy, it is crucial to implement carbon markets and associated mechanisms for both public and private sectors. These mechanisms, such as carbon pricing, carbon credits, and offsetting, form integral components of climate policy packages aimed at mitigating global emissions. Furthermore, they often serve as revenue streams for organizations operating in both sectors.

Carbon credits and offsetting residual carbon emissions represent pivotal steps towards achieving Net Zero objectives. Once annual emission targets are met through the implementation of emission reduction measures, organizations must offset any remaining emissions. This approach enables countries and organizations to embark on the journey towards net zero emissions, progressively working towards long-term goals while mitigating the annual emission impact.

Moreover, AESG advocates for the establishment of voluntary or regulated carbon markets, aligned with emission trading schemes such as joint implementation and clean development mechanisms. These markets aim to facilitate efficient and cost-effective solutions by assigning a price to the social costs of emissions, supporting both public and private sector entities.

Regarding Tesla’s involvement in regulatory emissions credits, a carbon credit functions as a permit allowing a holding company to emit a specific quantity of carbon dioxide or other greenhouse gases. Each credit typically represents the emission of one ton of carbon dioxide. Carbon credits operate within the framework of a “cap-and-trade” system. As of April 2, 2024, the value of one carbon credit ranges from approximately $40 to $80. However, this valuation is subject to fluctuations driven by factors such as supply, demand, and regulatory influences.

NUCLEAR POWER PLANTS – HOW DO THEY WORK

Nuclear power plants generate electricity through a process called nuclear fission, which involves splitting atoms of uranium or plutonium. Here’s a simplified overview of how a nuclear power plant works:

- Nuclear Fuel:

- The heart of a nuclear power plant is the reactor core, where nuclear fission occurs.Fuel rods containing uranium-235 or plutonium-239 are placed in the reactor core.

- When a neutron strikes the nucleus of a uranium or plutonium atom, it can cause the nucleus to split into two smaller nuclei, releasing a large amount of energy in the form of heat.

- Control Rods:

- Control rods made of materials such as boron or cadmium are inserted into the reactor core.These control rods absorb neutrons, regulating the rate of the nuclear reaction.

- By adjusting the position of the control rods, operators can control the power output of the reactor.

- Heat Generation:

- As nuclear fission reactions occur in the reactor core, they produce a tremendous amount of heat.

- This heat is used to generate steam by heating water in a separate system called the primary coolant loop.

- Steam Generation:

- The steam produced by the primary coolant loop is directed to a turbine.

- The high-pressure steam causes the turbine blades to spin.

- Electricity Generation:

- The spinning turbine is connected to a generator, which converts mechanical energy into electrical energy.

- The generator produces electricity, which is then transmitted to the electrical grid for distribution to homes, businesses, and industries.

- Cooling:

- After passing through the turbine, the steam is condensed back into water in a separate system called the secondary coolant loop.The condensed water is then returned to the primary coolant loop to be heated again by the reactor core.

- Heat generated during the process is often released into the environment through cooling towers or bodies of water.

Overall, nuclear power plants harness the energy released from nuclear fission to produce electricity efficiently and reliably, with minimal greenhouse gas emissions compared to fossil fuel-based power plants. However, the operation of nuclear power plants requires careful regulation and safety measures to mitigate the risks associated with radioactive materials and potential accidents.

NUCLEAR PLANTS’ POWER GENERATING COSTS IN THE U.S. IN 2002-2022

- The generation of electricity through nuclear power plants in the United States costs 30.92 U.S. dollars per megawatt-hour in 2022.

- Production costs were highest in 2012, when they came to 51.22 U.S. dollars in 2022 prices, but have decreased ever since.

- Some 772 terawatt-hours of electricity is generated by U.S. nuclear plants every year.

NUCLEAR POWER IN THE USA

- The USA is the world’s largest producer of nuclear power, accounting for about 30% of worldwide generation of nuclear electricity.

- The country’s nuclear reactors produced 772 TWh in 2022, 18% of total electrical output.

- Vogtle 3 was connected to the grid in April 2023, followed by unit 4 in March 2024.

- The Inflation Reduction Act was signed into law in August 2022. The Act provides support for existing and new nuclear development through investment and tax incentives for both large existing nuclear plants and newer advanced reactors, as well as high-assay low enriched uranium (HALEU) and hydrogen production.

- Some states have liberalized wholesale electricity markets, which makes the financing of capital-intensive power projects difficult, and coupled with lower gas prices since 2009, have put the economic viability of some existing reactors and proposed projects in doubt.

ELECTRICITY SECTOR

- Total generation (in 2022): 4502 TWh

- Generation mix: natural gas 1742 TWh (39%); coal 909 TWh (20%); nuclear 804 TWh (18%); wind 440 TWh (10%); hydro 286 TWh (6%); solar 189 TWh (4%); biofuels & waste 66.8 TWh; oil 41.5 TWh; geothermal 19.6 TWh.

- Import/export balance: 41.2 TWh net import (56.9 TWh imports; 15.7 TWh exports)

- Total consumption: 4071 TWh

- Per capita consumption: c. 12,000 kWh in 2022

- In its Annual Energy Outlook 2022, the US Energy Information Administration’s (EIA’s) reference case shows electricity demand growth averaging 1% per year through to 2050.

- Nuclear power plays a major role in electricity provision across the country. The US fleet is operated by 30 different power companies across 30 different states. Since 2001 these plants have achieved an average capacity factor of over 90%. The average capacity factor has risen from 50% in the early 1970s, to 70% in 1991, and it passed 90% in 2002, remaining at around this level since. In 2019 it was a record 94%, compared with wind (32%) and solar PV (22%) (EIA data). The industry invests about $7.5 billion per year in maintenance and upgrades of the plants.

- Given that nuclear plants generate nearly 20% of the nation’s electricity overall and about 55% of its carbon‐free electricity, even a modest increase in electricity demand would require significant new nuclear capacity in order to maintain this share. If today’s nuclear plants retire after 60 years of operation, 22 GWe of new nuclear capacity would be needed by 2030, and 55 GWe by 2035 to maintain a 20% nuclear share.

HOW ARE FOSSIL FUELS USED TO GENERATE ELECTRICITY IN THE USA

In the USA, fossil fuels are a major source of electricity generation, accounting for a significant portion of the country’s energy mix. The primary fossil fuels used for electricity generation in the USA are coal, natural gas, and, to a lesser extent, petroleum. Here’s how each of these fossil fuels is used to generate electricity:

- Coal:

- Coal-fired power plants are one of the oldest and most common methods of generating electricity in the USA.Coal is typically pulverized into a fine powder and then burned in a boiler to produce steam.The steam produced from burning coal is used to drive a turbine connected to a generator, which converts mechanical energy into electrical energy.

- Coal-fired power plants often use technologies such as flue gas desulfurization (scrubbers) and electrostatic precipitators to reduce emissions of sulfur dioxide (SO2), nitrogen oxides (NOx), and particulate matter.

- Natural Gas:

- Natural gas-fired power plants have become increasingly popular in the USA due to the abundance of natural gas resources and advancements in gas turbine technology.Natural gas can be burned directly in a gas turbine to produce mechanical energy, which is then used to drive a generator to produce electricity (known as simple cycle gas turbine).Alternatively, natural gas can be used in combined-cycle power plants, where the exhaust heat from a gas turbine is captured to generate steam, which drives a steam turbine connected to a generator (known as combined-cycle gas turbine).

- Combined-cycle power plants are more efficient than simple cycle plants and are often used for baseload and peaking power generation.

- Petroleum:

- Petroleum (primarily in the form of fuel oil) is used less frequently than coal and natural gas for electricity generation in the USA, primarily due to its higher cost and environmental concerns.Petroleum-fired power plants operate similarly to natural gas-fired plants, where the fuel is burned to produce steam that drives a turbine connected to a generator.Petroleum-fired power plants are typically used as backup or emergency generators or in regions where other fuel sources are not readily available.

- Overall, fossil fuel-fired power plants play a significant role in meeting electricity demand in the USA, providing baseload, intermediate, and peaking power generation. However, concerns about air pollution, greenhouse gas emissions, and climate change have led to increased interest in cleaner and renewable energy sources as alternatives to fossil fuels for electricity generation.

FOSSIL FUELS ARE THE LARGEST SOURCES OF ENERGY FOR ELECTRICITY GENERATION

- Natural gas was the largest source—about 40%—of U.S. electricity generation in 2022. Natural gas is used in steam turbines and gas turbines to generate electricity.

- Coal was the third-largest energy source for U.S. electricity generation in 2022—about 18%. Nearly all coal-fired power plants use steam turbines. A few coal-fired power plants convert coal to a gas for use in a gas turbine to generate electricity.

- Petroleum was the source of less than 1% of U.S. electricity generation in 2022. Residual fuel oil and petroleum coke are used in steam turbines. Distillate—or diesel—fuel oil is used in diesel-engine generators. Residual fuel oil and distillates can also be burned in steam and gas turbines.

COST OF OPERATING PLANTS POWERED BY FOSSIL FUELS

- EIA sorted these coal plants into three groups based on their average operating and maintenance costs. The highest cost group operated at costs ranging from $28 per megawatthour (MWh) to $40/MWh, and the lowest cost group operated at $20/MWh to $26/MWh. A middle group operated near the fleet average, ranging from $26/MWh to $28/MWh from 2008 through 2017.

- The costs to run and maintain a power plant in the United States varies greatly by the type of power plant being operated. In 2017, an advanced nuclear power plant had fixed costs that totaled about 101.28 U.S. dollars per kilowatt per year, while its variable costs reached 2.32 U.S. dollars per megawatt hour. In comparison, a conventional gas/oil combination cycle plant has about 11.11 U.S. dollars per kilowatt per year in fixed costs with 3.54 U.S. dollars per megawatt hour in variable costs.